Martin Dew

Decline in Pay TV Subscriptions = Increase in Digital Antennas

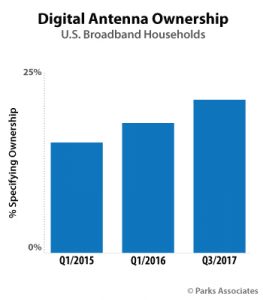

It might seem counter-intuitive in this era of on-demand entertainment and easy subscription services, but new data from market research firm Park Associates indicates that the percentage of US broadband households using digital antennas has been steadily increasing year-on-year, having reached a 20% residential deployment by the end of 2017. This figure is up 16% on the previous year, and the company goes on to reveal the increase coincides with a steady decline in pay-TV subscriptions and growth in OTT video subscriptions.

“Increasingly, consumers are cobbling together their own bundles of content sources. Digital antennas are experiencing a resurgence as consumers consider over-the-air TV and OTT video services as alternatives to pay TV,” said Brett Sappington, Senior Director of Research, Parks Associates. “The percentage of ‘Never’ households (households that have never subscribed to pay-TV services) has held steady, and the percentage of households actually cutting the cord has increased between 2015 and 2017. Antennas are an affordable source for local channels to these households.”

Parks Associates suggests that the 'high cost and low price/value perception' are the main reasons for service and cancellation and bundle shaving, and more than 50% of households that have switched, pared back, or cut the cord believe the service is 'not worth the cost'.

“Pay-TV providers need to address this value perception gap and re-establish their role as the consumers’ source for interesting content,” Sappington said. “Opportunities are available. Only 46% of pay-TV subscribers are aware that they can access video-on-demand content from their operator, including free programming. Many indicate that they want to purchase online video services through their pay-TV provider and to access the service through their channel guide.”

Additional research has also shown that 63% of subscribers who cannot currently restart programs from the beginning find that feature to be appealing, 17% of consumers who cancel their pay-TV service would have stayed with their provider if there were no monthly fees for their set-top boxes, average fees for standalone broadband have increased nearly 25% since 2010, and 20% of Wi-Fi households experience problems with coverage in their home.

Decline in Pay TV Subscriptions = Increase in Digital Antennas

It might seem counter-intuitive in this era of on-demand entertainment and easy subscription services, but new data from market research firm Park Associates indicates that the percentage of US broadband households using digital antennas has been steadily increasing year-on-year, having reached a 20% residential deployment by the end of 2017. This figure is up 16% on the previous year, and the company goes on to reveal the increase coincides with a steady decline in pay-TV subscriptions and growth in OTT video subscriptions.

“Increasingly, consumers are cobbling together their own bundles of content sources. Digital antennas are experiencing a resurgence as consumers consider over-the-air TV and OTT video services as alternatives to pay TV,” said Brett Sappington, Senior Director of Research, Parks Associates. “The percentage of ‘Never’ households (households that have never subscribed to pay-TV services) has held steady, and the percentage of households actually cutting the cord has increased between 2015 and 2017. Antennas are an affordable source for local channels to these households.”

Parks Associates suggests that the 'high cost and low price/value perception' are the main reasons for service and cancellation and bundle shaving, and more than 50% of households that have switched, pared back, or cut the cord believe the service is 'not worth the cost'.

“Pay-TV providers need to address this value perception gap and re-establish their role as the consumers’ source for interesting content,” Sappington said. “Opportunities are available. Only 46% of pay-TV subscribers are aware that they can access video-on-demand content from their operator, including free programming. Many indicate that they want to purchase online video services through their pay-TV provider and to access the service through their channel guide.”

Additional research has also shown that 63% of subscribers who cannot currently restart programs from the beginning find that feature to be appealing, 17% of consumers who cancel their pay-TV service would have stayed with their provider if there were no monthly fees for their set-top boxes, average fees for standalone broadband have increased nearly 25% since 2010, and 20% of Wi-Fi households experience problems with coverage in their home.

Last edited: