“If you need a tutorial for your credit card, you’re doing it wrong” — Steve Jobs

Home Theater

Entertainment & Streaming Content

Physical Media

Home Theater Equipment and Hardware

Other Diversions

Bargains and Classifieds

Home Theater Forum

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

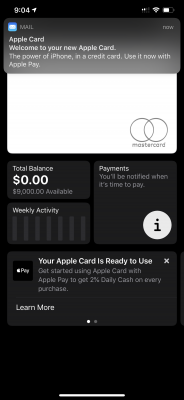

Are You Getting An Apple Card? (1 Viewer)

- Thread starter Ronald Epstein

- Start date

-

- Tags

- apple

More options

Who Replied?“If you need a tutorial for your credit card, you’re doing it wrong” — Steve Jobs

Yep yep!

- Joined

- Jul 3, 1997

- Messages

- 66,750

- Real Name

- Ronald Epstein

- Joined

- Mar 28, 2016

- Messages

- 3,038

- Real Name

- Patrick

So with an Apple Card - do you connect a checking account to it in order to make a payment on your balance?

Last edited:

- Joined

- Jul 3, 1997

- Messages

- 66,750

- Real Name

- Ronald Epstein

I don’t know. It’s not a debit card so I would say no

- Joined

- Mar 28, 2016

- Messages

- 3,038

- Real Name

- Patrick

I don’t know. It’s not a debit card so I would say no

Then how do you pay your balance?

No invite here

I think Ron misunderstood the question. No doubt you set up an account to pay your balance, just like I do with any credit card I have now and pay online.Then how do you pay your balance?

Then how do you pay your balance?

In that respect I'd assume that you would have to link a payment account of some type to the card, as you do with any credit card if you want to pay your balance electronically.

- Joined

- Jul 3, 1997

- Messages

- 66,750

- Real Name

- Ronald Epstein

It works just like any other credit card.

You either get billed monthly or it gets taken out of your bank account if you have some sort of additional electronic payment set up.

However, Apple Card does not link directly to your checking account.

You either get billed monthly or it gets taken out of your bank account if you have some sort of additional electronic payment set up.

However, Apple Card does not link directly to your checking account.

I wonder if maybe that was true 30 or 40 years ago. There's certainly no truth to it today. What I've learned is there are actually pretty basic rules to good credit. First, pay your bills on time. That's simple enough. Phone, utilities, etc, get reported if you don't pay reliably. Second, have credit available, even if you don't use it much. Unused credit seems to be something ratings really like. Third, don't change creditors very often. IOW, open a couple credit accounts, and keep them.There are so many myths and confusions and subsequent bad advice on basic personal finance out there. I recently saw a really bad one on iMore.com from the iMore Managing Editor, claiming that you have to not pay your credit card bill every month to have good credit. That's completely wrong, a financially harmfully finance myth perhaps stemming from a basic misunderstanding of how credit scores are (partly) based on credit utilization.

(sigh)

BTW, if your rating is already low, then unused credit actually seems to hurt you, but generally people with bad credit don't have any unused credit.

- Joined

- Jul 3, 1997

- Messages

- 66,750

- Real Name

- Ronald Epstein

I wonder if maybe that was true 30 or 40 years ago. There's certainly no truth to it today. What I've learned is there are actually pretty basic rules to good credit. First, pay your bills on time. That's simple enough. Phone, utilities, etc, get reported if you don't pay reliably. Second, have credit available, even if you don't use it much. Unused credit seems to be something ratings really like. Third, don't change creditors very often. IOW, open a couple credit accounts, and keep them.

BTW, if your rating is already low, then unused credit actually seems to hurt you, but generally people with bad credit don't have any unused credit.

John, exactly what I have learned over the years.

That's awful, awful advice from iMore. Really idiotic, in fact. Not paying your card every month helps your credit?!

One of the things that temporarily hurts your credit is opening a new credit card account.

However, in the long run, that hit is temporary and your credit score goes back up as long as you pay all your bills on time.

One thing you should never do is cancel credit cards. It seems that holding on to those cards shows you have more credit available.

Now with all that said, I am not offering this as professional advice. This is just tips I have learned over the years.

My understanding regarding large amounts of unused credit card credit is that it's detrimental if you want to finance a large purchase, such as a car or taking out a mortgage on a house. I've always been told that lending institutions count any unsecured credit UP TO AND INCLUDING your entire credit limit when considering your application. For example, if you have 4 credit cards with a total of $20K in available but unused credit, that entire amount is considered to be a liability, since you can use it all at any time with just a signature. True or false?

- Joined

- Jul 3, 1997

- Messages

- 66,750

- Real Name

- Ronald Epstein

I'll have my financial advisor call you on that one, Doug.

I'll have my financial advisor call you on that one, Doug.

Thanks Ron!

- Joined

- Mar 28, 2016

- Messages

- 3,038

- Real Name

- Patrick

My understanding regarding large amounts of unused credit card credit is that it's detrimental if you want to finance a large purchase, such as a car or taking out a mortgage on a house. I've always been told that lending institutions count any unsecured credit UP TO AND INCLUDING your entire credit limit when considering your application. For example, if you have 4 credit cards with a total of $20K in available but unused credit, that entire amount is considered to be a liability, since you can use it all at any time with just a signature. True or false?

False, with the caveat that it depends how long your accounts have been open.

The best thing you can do is have a lot of unused credit on accounts you have had open for a long time.

Having $20K available to you on accounts you just opened is not as good as having $20K available to you on accounts you opened 20 years ago, but it is definitely not a liability.

I have 1 credit card with a $15K limit, that I opened 20 years ago, and it sits in a safe.

- Joined

- Mar 28, 2016

- Messages

- 3,038

- Real Name

- Patrick

As a complete aside I thought I'd share this - I was recently going to sign a lease on an apartment and they wanted $60 to run a credit check. I took out my phone and opened the Equifax app, which showed the score and all the detailed info they could possibly need... and they still wanted the $60

My understanding, and what I have been told by the rep at my local bank, where I do all my banking both personally and for business, is that is not correct. I have a specific individual that I have worked with for about 10 years, any time I apply for something through that bank, it is automatically directed to her. It's not enormous amounts, but I have a line of credit for the business, and a couple years ago I financed the purchase of the car I had been leasing. I asked specifically about these things, and my understanding is that the best situation you can be in, which is in line with what Ron said, is to have long standing credit that you have proven to be responsible with. Purchases like a car or house are secured (to some degree) by the value of the purchase, and are completely different from unsecured credit, like credit cards. In that case, the lender just wants to know they can recoup the loan if it defaults, by repossessing the property.My understanding regarding large amounts of unused credit card credit is that it's detrimental if you want to finance a large purchase, such as a car or taking out a mortgage on a house. I've always been told that lending institutions count any unsecured credit UP TO AND INCLUDING your entire credit limit when considering your application. For example, if you have 4 credit cards with a total of $20K in available but unused credit, that entire amount is considered to be a liability, since you can use it all at any time with just a signature. True or false?

To take after Ron, this is not professional advice. Just passing on what I understand.

There's so much voodoo involved in credit scores and lending, but I've always felt that what I outlined above was reasonably plausible. Having that much unsecured credit available and then maxing it out after buying a house, for example, could easily make it harder for you to cover your mortgage payments, therefore making it much more likely that you could default on your loan. I'll have to do some more digging around on this. Anyway guys, I appreciate the feedback.

Malcolm R

Senior HTF Member

- Joined

- Feb 8, 2002

- Messages

- 25,222

- Real Name

- Malcolm

Ironically, your credit rating can also get dinged when you payoff/close an account. When I paid off my car loan a couple years ago, my FICO dipped about 25-35 points, then started rising again after a couple months.

No interest in an Apple card. I already have long-term cards that have treated me well and I pay them off every month. No need for any more, or to switch.

No interest in an Apple card. I already have long-term cards that have treated me well and I pay them off every month. No need for any more, or to switch.

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)

Sign up for our newsletter

and receive essential news, curated deals, and much more

Similar Threads

Members online

- Osato

- Chip_HT

- Steve Armbrust

- jordanr3ennett

- Josh Steinberg

- Worth

- ManW_TheUncool

- Robert Saccone

- jkholm

- Mark B

- Sinbad75

- JimJasper

- Demetrios Patsiaris

- Garysb

- Morgan Jolley

- Keith Cobby

- rkirk

- Robert_Zohn

- Todd Erwin

- SD_Brian

- Bob Furmanek

- t1g3r5fan

- Neil S. Bulk

- [email protected]

- PODER

- TonyD

- Jonathan Perregaux

- Drjoel65

- JohnHopper

- xochipilli

- Brian Ogilvie

- MarkantonyII

- Neil Middlemiss

- John Hermes

- ronr22

- nbellis2001

- FP62

- dana martin

- Powell&Pressburger

- ChristopherG

Total: 802 (members: 45, guests: 757)

Forum statistics

- Threads

- 357,037

- Messages

- 5,129,269

- Members

- 144,286

- Latest member

- acinstallation172

- Recent bookmarks

- 0